Introduction

In the Forex market, identifying an accurate trading strategy is essential for consistent profits. Various strategies exist, each with unique strengths and applications, and accuracy depends on factors like timing, market conditions, and currency pairs. By understanding the core principles of high-performing strategies, traders can select methods that suit their objectives. This article analyzes some of the most effective strategies, focusing on their mechanics, data-backed performance, and reliability in different scenarios.

1. Scalping: Fast-Paced, High-Frequency Trading

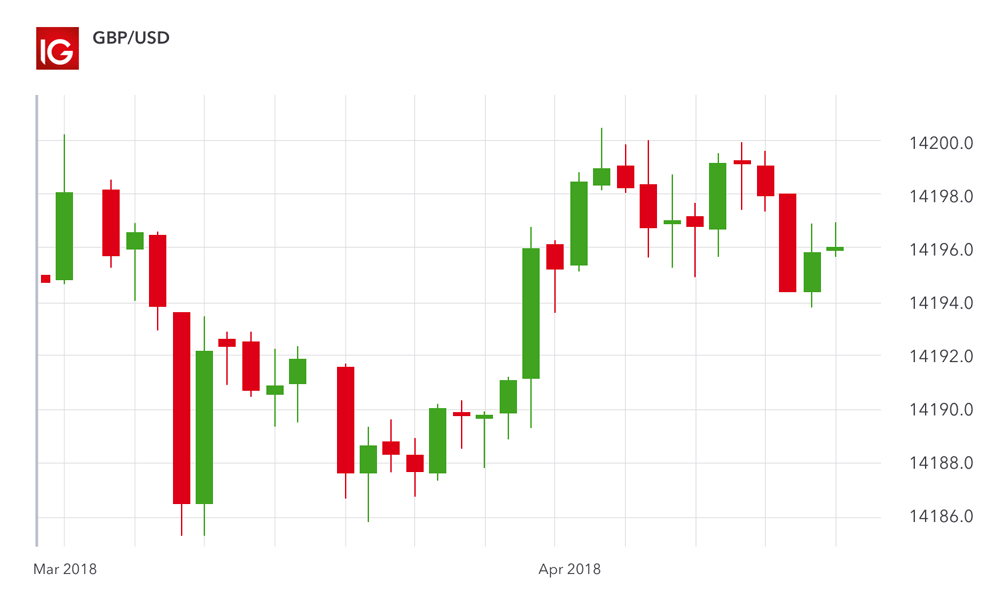

Scalping is a popular strategy for traders seeking frequent, quick profits through short-term trades. This strategy relies on high-frequency trades to capture small price movements in liquid currency pairs like EUR/USD, GBP/USD, and USD/JPY.

Methodology: Scalping involves opening and closing multiple trades within minutes or even seconds, aiming to capture small pips (price movements) within each trade. Scalpers typically use 1-minute or 5-minute charts and employ technical indicators like moving averages, Bollinger Bands, and Relative Strength Index (RSI) to identify potential entry and exit points.

Performance Data: According to Forex Factory’s user statistics, scalping can yield high returns, with some scalpers achieving daily profits ranging from 5-10% of their capital during optimal market conditions. However, scalping requires precision and strong risk management due to its fast-paced nature.

Suitability for Traders: Scalping is effective for traders who can monitor the market closely and react quickly to changes. It’s also recommended for brokers with tight spreads and low commission rates, such as IC Markets and Pepperstone, which support scalpers through fast execution and low-latency infrastructure.

Feedback from scalpers highlights the strategy’s potential for consistent gains, although they caution that it demands focus and discipline. When properly managed, scalping is one of the most accurate methods for traders looking for rapid returns.

2. Swing Trading: Capturing Intermediate Price Swings

Swing trading is a mid-term strategy ideal for traders who aim to capture price swings within a few days or weeks. This approach combines technical and fundamental analysis, targeting currency pairs experiencing clear trends.

Methodology: Swing traders identify entry and exit points by analyzing trend indicators like moving averages, Fibonacci retracements, and support and resistance levels. Typically, swing traders hold positions for several days, allowing them to capture larger price movements without the need for constant market monitoring.

Performance Insights: Swing trading has been shown to yield positive results, with reported monthly returns averaging between 5-15%, depending on market volatility. For instance, the EUR/USD pair exhibited a profitable trend for swing traders between Q1 and Q3 of 2022, with a significant upward swing of over 10%, driven by macroeconomic factors and ECB interest rate adjustments.

Preferred Brokers and Platforms: Brokers like FXCM and XM offer educational resources and technical tools that support swing trading. MetaTrader 4 and TradingView are commonly used by swing traders for their analytical capabilities.

Swing trading is well-regarded among Forex Factory community members, who report that its relaxed pace and reliance on technical indicators make it accessible for those unable to monitor trades constantly. This strategy’s accuracy improves when combined with fundamental insights and patience, especially in trending markets.

3. Trend Following: Leveraging Long-Term Market Direction

Trend following is a strategy based on the idea that prices move in sustained trends, and traders can profit by aligning with these long-term market directions. This approach is suited to both beginners and experienced traders who aim for stable, long-term gains.

Methodology: Trend followers utilize indicators like moving averages, trendlines, and the Average Directional Index (ADX) to identify trends and confirm their strength. Positions are held for weeks or months, allowing traders to ride the trend until reversal signals appear.

Data on Effectiveness: Trend-following strategies have shown consistent performance in markets with strong trends. For example, traders following the USD/JPY upward trend in 2021-2022 capitalized on its 20% appreciation, attributed to interest rate differentials between the U.S. and Japan. Studies by Myfxbook indicate that trend-following strategies yield higher returns during trending periods, with average monthly gains of 3-8%.

Trading Platforms and Brokers: Platforms like MetaTrader 5 and cTrader are popular for trend following due to their advanced charting tools. Brokers such as OANDA provide historical data and sentiment analysis, useful for tracking long-term trends.

Trend following is frequently recommended for traders seeking stability and accuracy, as it relies on the natural movement of markets. User reviews highlight its reliability, especially in markets with prolonged trends driven by macroeconomic factors.

4. Breakout Trading: Capitalizing on Volatility

Breakout trading is a strategy that involves entering positions when a currency pair moves beyond established support or resistance levels. It’s a favored approach for traders aiming to capitalize on sudden volatility, particularly around news events or major economic data releases.

Strategy Mechanics: Breakout traders set buy or sell orders around significant price levels, such as previous highs and lows. When the price breaches these levels, a new trend may begin, and traders enter positions accordingly. Indicators like the Moving Average Convergence Divergence (MACD) and Bollinger Bands help confirm breakouts.

Performance Data: Breakout trading has demonstrated high accuracy when executed during high-impact events, such as central bank announcements. For example, in 2022, the U.S. Federal Reserve’s rate hikes triggered breakouts in USD pairs, resulting in large movements. Reported returns from breakout trading vary based on volatility but can reach up to 10-20% in high-volume trading sessions.

Best Brokers for Execution: Brokers like Pepperstone and FXCM, which offer tight spreads and fast execution, are preferred by breakout traders to reduce slippage during volatile periods. MetaTrader platforms support breakout trading with custom indicators and alerts.

Breakout trading receives positive feedback from Forex Factory users who leverage it during news releases, with traders noting its accuracy in volatile sessions. However, breakout trading requires discipline, as false breakouts can lead to losses if not managed correctly.

5. Mean Reversion: Profiting from Price Corrections

Mean reversion is a strategy based on the assumption that prices revert to their historical averages after significant deviations. This strategy is ideal for range-bound markets, where currency pairs oscillate within a defined range.

Approach: Mean reversion traders identify overbought or oversold conditions using indicators like the Relative Strength Index (RSI) and Bollinger Bands. When prices reach extreme levels, traders enter positions expecting a reversal toward the mean.

Evidence of Effectiveness: Mean reversion performs well in non-trending markets, with average monthly returns ranging from 3-7% when markets remain stable. In 2021, USD/CHF exhibited mean-reverting behavior due to stable interest rates, providing opportunities for traders using this strategy.

Suitable Platforms: MetaTrader 4 and TradingView offer indicators that support mean reversion trading. OANDA and IC Markets are frequently used by mean reversion traders for their access to technical indicators.

User feedback highlights mean reversion’s stability, especially for traders who avoid volatile markets. This strategy’s accuracy is generally high in low-volatility environments, making it ideal for steady returns.

Conclusion

Accurate trading strategies depend on the trader’s approach, market conditions, and the tools available. Scalping is well-suited for traders seeking quick profits, while swing trading balances short-term and long-term objectives. Trend following provides stability during strong market trends, and breakout trading captures volatility during high-impact events. Finally, mean reversion capitalizes on price corrections in range-bound markets. Each of these strategies demonstrates accuracy when applied appropriately, supported by reliable platforms and technical indicators. By understanding the nuances of each strategy, traders can align their goals with market dynamics and achieve consistent results.

Boost your Forex earnings with the best forex rebates available!