Forex trading has become a popular choice for many looking to dive into the world of financial markets. As a highly liquid and decentralized market, Forex trading offers both opportunities and challenges, especially for beginners. However, the question remains: is it truly profitable for those just starting out? While the potential for substantial gains exists, success in Forex trading requires more than just understanding the basics. It demands strategy, discipline, and a keen awareness of market conditions.

Understanding the Basics of Forex Trading

Before diving into Forex trading, it's essential to understand its fundamental components. Learning how the market operates and what tools you’ll need to succeed can set you on the right path.

What is Forex Trading?

Forex trading involves buying and selling currencies in the global marketplace. Here’s an overview of some core concepts:

Currency Pairs: Forex operates through pairs like EURUSD or GBPJPY. The first currency is the "base" and the second is the "quote" currency.

Trading Hours: The market is open 24 hours, five days a week, making it highly accessible to traders around the world.

Leverage: Forex traders can use leverage to control larger positions than their actual investment, but it can also magnify both profits and losses.

How Does Forex Trading Work?

Forex trading relies on the dynamics between two currencies. Here's a look at the process:

Currency Transactions: To make a trade, you simultaneously buy one currency and sell another. For example, trading EURUSD means buying the Euro and selling the US Dollar.

Factors Affecting Prices: Currency prices fluctuate based on factors such as interest rates, economic data, geopolitical events, and market sentiment.

Currency Pair Examples: Key pairs like EURUSD and GBPJPY can offer different liquidity levels, influencing trading strategies.

The Major Currency Pairs to Know

Understanding the most traded currency pairs is crucial for beginners to navigate Forex markets effectively. Below is a table highlighting major pairs and their characteristics:

| Currency Pair | Volatility | Liquidity | Average Spread | Best Time to Trade |

|---|---|---|---|---|

| EURUSD | Low | High | 0.1-0.3 pips | London & New York |

| GBPUSD | Moderate | High | 0.8-1.2 pips | London & New York |

| USDJPY | Low | High | 0.2-0.4 pips | Tokyo & New York |

Types of Forex Trading Accounts

For beginners, choosing the right type of trading account is essential. Here are the main options:

Standard Account: Offers full access to the Forex market with typical leverage.

Mini Account: Requires a lower initial deposit and lets you trade smaller amounts, ideal for beginners testing strategies.

Demo Account: Allows you to practice trading with virtual money, providing a risk-free environment to build experience.

Key Tools and Platforms for Forex Trading

For success in Forex trading, utilizing the right tools and platforms is crucial. This section highlights some of the key resources available to Forex traders, with a focus on platforms, brokers, and analytical tools.

Popular Forex Trading Platforms

Several trading platforms cater to different types of traders. Here are a few popular ones:

MetaTrader 4 (MT4): The most widely used platform, offering advanced charting tools, expert advisors (EAs), and an intuitive interface for traders.

MetaTrader 5 (MT5): An upgraded version of MT4, featuring more timeframes, additional order types, and integrated fundamental analysis tools.

TradingView: A cloud-based charting platform popular for its social trading features and ease of use, ideal for both beginner and advanced traders.

cTrader: Known for its user-friendly interface and advanced charting features, this platform appeals to traders seeking customization.

Choosing the Right Forex Broker

When selecting a Forex broker, several key factors come into play. These include:

Spread Rates: Narrower spreads reduce the cost of each trade, which is particularly important for active traders.

Leverage Options: Brokers provide different leverage ratios, influencing your potential profit or loss.

Regulation: Look for brokers regulated by recognized financial authorities to ensure your funds are safe.

Customer Support: Responsive support is essential for resolving issues and queries promptly.

Understanding Trading Indicators for Beginners

Indicators are essential tools for analyzing market trends and guiding trading decisions. Key indicators include:

Moving Averages: Used to smooth out price data and identify trends.

Relative Strength Index (RSI): Measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

Bollinger Bands: Provide insight into market volatility by displaying a band around a moving average.

MACD: A trend-following momentum indicator used to identify changes in the strength, direction, and duration of a trend.

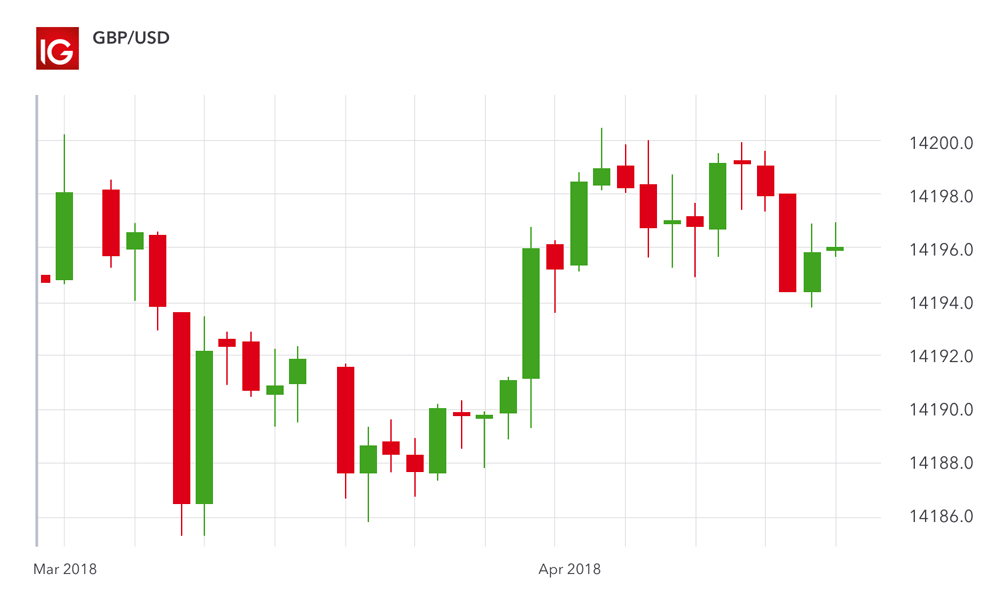

The Role of Forex Charts in Analysis

Charts are the primary method of visualizing price movements in Forex trading. Candlestick charts, in particular, offer useful insights into market behavior.

Candlestick Patterns: These patterns reveal market sentiment and potential price reversals.

Chart Types: Common types include line charts, bar charts, and candlestick charts.

Price Action: Traders analyze the movements of price over time to predict future market movements based on historical data.

Using Timeframes in Forex Trading

Timeframes play a crucial role in shaping your trading strategy. Choosing the right timeframe is essential to match your trading style:

M1 (1-minute): Perfect for scalpers who trade on very short-term movements.

H1 (1-hour): Suitable for day traders who want to capitalize on medium-term price action.

D1 (1-day): Ideal for swing traders focusing on longer-term trends and price movements.

By mastering the use of Forex platforms, brokers, indicators, charts, and timeframes, beginners can make informed decisions in the fast-moving Forex market. These tools, when combined, form a strong foundation for successful trading.

Forex Trading Strategies for Beginners

In Forex trading, understanding and implementing effective strategies is key to success.

The Basics of Day Trading in Forex

Day trading is an appealing strategy for beginners, allowing traders to capitalize on short-term price movements within a single trading day.

Market Orders: These are orders to buy or sell at the current market price, ideal for quick execution.

Limit Orders: Used to buy or sell at a specific price or better, offering more control over trade entry and exit.

Day trading relies on short-term trends, often utilizing tools like the Moving Average and RSI indicators to make decisions.

Swing Trading vs Scalping: Which is Best for Beginners?

Swing trading and scalping are both popular, but they differ significantly:

Swing Trading: A medium-term strategy where positions are held for several days or weeks, taking advantage of larger price movements.

Pros: Fewer trades, less stress, and better suited for part-time traders.

Cons: Longer exposure to market risk.

Scalping: Involves making many small trades over a short period (minutes), targeting small price movements.

Pros: Quick returns and more trading opportunities.

Cons: Requires intense focus, fast decision-making, and higher transaction costs.

Choosing between the two depends on a trader's available time, risk tolerance, and trading style.

Understanding Risk Management in Forex

Effective risk management is crucial to prevent large losses. Key tools include:

Stop Loss: A predefined price level at which a trade is automatically closed to limit potential losses.

Take Profit: Sets a target level to lock in profits once the price reaches a predetermined level.

Position Sizing: Determines how much capital to risk on each trade, helping maintain an optimal risk-to-reward ratio.

Risk-Reward Ratio: Aiming for a higher potential reward than the risk involved, often set at 2:1 or higher.

| Risk Management Tool | Description | Importance for Beginners |

|---|---|---|

| Stop Loss | Automatically closes a trade at a loss limit | Protects capital |

| Take Profit | Closes a trade once a profit target is hit | Secures gains |

| Position Sizing | Controls how much to risk per trade | Avoids overexposure |

| Risk-Reward Ratio | Helps balance risk and potential returns | Increases trading efficiency |

The Importance of a Trading Plan for Beginners

A solid trading plan is essential for managing expectations and staying disciplined in the face of market fluctuations.

Goal Setting: Clearly define your trading goals, such as profit targets or learning objectives.

Trade Criteria: Outline when to enter and exit trades, the indicators or chart patterns to rely on, and risk management strategies.

Emotional Control: A trading plan helps mitigate emotional trading, which often leads to impulsive decisions and significant losses.

Having a well-structured plan makes it easier to track progress and adjust strategies as needed.

These strategies, combined with proper risk management and a clear trading plan, provide a robust foundation for beginners in the Forex market. By mastering these tools, traders can navigate the complexities of Forex trading with more confidence.

Advanced Forex Trading Techniques

For traders who have mastered the basics, advanced Forex trading techniques provide a deeper understanding of leverage, technical analysis, and market cycles. These concepts can amplify profits but require careful execution and discipline.

Leveraging Forex for Greater Profit

Leverage allows traders to control larger positions with a smaller amount of capital, increasing both the potential return and risk.

How Leverage Works: By using leverage, a trader can trade larger positions in pairs like EURUSD, for example, without needing the full capital to support the trade.

The Double-Edged Sword: While leverage can amplify profits, it can also magnify losses if the market moves unfavorably. Therefore, traders must use leverage cautiously, especially when managing Risk-Reward Ratios.

Example: A 10:1 leverage allows you to control $10,000 with just $1,000 in margin. If the trade moves in your favor by 1%, your profit would be $100. But if it moves against you by 1%, your loss is also $100.

Using Technical Analysis to Predict Market Trends

Technical analysis involves using charts and indicators to forecast market movements. Advanced indicators such as the MACD, Fibonacci Retracement, and Stochastic Oscillator provide critical insights:

MACD (Moving Average Convergence Divergence): Tracks momentum and trend direction by comparing two moving averages.

Fibonacci Retracement: Identifies potential reversal levels based on key Fibonacci levels, such as 38.2%, 50%, and 61.8%.

Stochastic Oscillator: Measures the momentum of price movements by comparing a currency's closing price to its price range over a specific period.

These tools allow traders to make data-driven decisions and optimize their entry and exit strategies.

| Indicator | Purpose | Best Use Case |

|---|---|---|

| MACD | Identifies momentum shifts and trends | Trend-following strategies, momentum trades |

| Fibonacci Retracement | Locates possible price retracements | Identifying potential reversal points |

| Stochastic Oscillator | Measures momentum | Determining overbought/oversold conditions |

Understanding Forex Market Cycles

The Forex market operates in cycles, with patterns of trends and corrections that repeat over time. Recognizing these cycles helps predict future price movements.

Market Phases: The Forex market moves through accumulation, markup, distribution, and markdown phases. These phases reflect how market sentiment shifts, from periods of low activity to high volatility.

How Cycles Influence Trends: Understanding where the market is in its cycle can help traders choose the right strategy. For example, trend-following strategies work best in a markup phase, while range-bound strategies are more effective during the accumulation phase.

Practical Use: By observing historical patterns, traders can anticipate turning points, using technical indicators like Moving Averages or Bollinger Bands to confirm their predictions.

In conclusion, these advanced techniques—leveraging Forex pairs, using technical analysis tools, and recognizing market cycles—equip traders with the skills to refine their strategies and improve their risk management.

Risks and Challenges in Forex Trading

Forex trading offers high profit potential but comes with significant risks.

Common Risks in Forex Trading

Forex trading, though profitable, involves several risks that every trader must be aware of:

Market Volatility: The Forex market is extremely volatile, with currency pairs like EURUSD and GBPUSD often showing unpredictable price swings. Such fluctuations can result in sudden gains or losses.

Slippage: This occurs when orders are executed at a different price than expected. It’s common during high volatility, particularly with Market Orders or Stop Orders.

Leverage Risks: Using high leverage, such as 50:1 or 100:1, can amplify both profits and losses, potentially wiping out an account in extreme conditions.

Liquidity Risk: During off-hours or with less traded currency pairs, liquidity can be low, leading to difficulty executing trades at desired prices.

The Psychology of Forex Trading

Trading isn’t just about charts and technical analysis; it’s also about controlling your emotions. The psychological aspect of trading plays a huge role in success or failure.

Fear and Greed: These emotions can lead to hasty decisions. For example, fear may cause a trader to close a position prematurely, while greed can lead to overleveraging.

Overconfidence: Beginners often make the mistake of overestimating their ability to predict markets after a few successful trades, increasing their exposure to risk.

Emotional Control: Maintaining discipline and following your trading plan is essential. Successful traders often use tools like Stop Loss and Take Profit to minimize emotional decisions.

How to Avoid Forex Trading Scams

Forex scams are unfortunately common, and beginners need to be vigilant.

Unrealistic Promises: Be cautious of brokers or systems promising guaranteed profits. Real trading doesn’t promise easy returns.

Unregulated Brokers: Ensure your broker is regulated by authorities such as the Financial Conduct Authority (FCA) or Commodity Futures Trading Commission (CFTC).

Dodgy Platforms: Choose reliable platforms like MetaTrader 4 or cTrader, and avoid platforms with no clear track record or user reviews.

| Warning Signs of Forex Scams | What to Look For | Action Steps |

|---|---|---|

| Unrealistic Promises | Promises of guaranteed returns | Stick to regulated brokers only |

| Unregulated Brokers | Lack of regulation by financial authorities | Research broker's background and licensing |

| No Customer Reviews | Negative or non-existent reviews | Look for reviews from trusted sources |

Dealing with Losses in Forex Trading

Losses are an inevitable part of Forex trading, but how traders handle them can significantly affect their future success.

Emotional Impact: Losses can lead to frustration, anxiety, or even depression. Acknowledging this emotional toll is essential for growth.

Risk Management: Use Stop Losses and Position Sizing to ensure losses remain manageable. A common recommendation is never risking more than 1-2% of your account balance on any single trade.

Learn from Losses: Every loss provides a learning opportunity. Keep a trading journal to review your trades and improve your decision-making process.

Regulations in Forex Trading

Forex trading is subject to various regulations, depending on your region. Understanding these rules can protect you from fraud and ensure fair practices:

U.S. Regulations: The CFTC and NFA regulate Forex trading in the U.S., ensuring transparency and protecting traders.

European Regulations: The FCA and ESMA set rules for brokers in the U.K. and EU, ensuring that they meet capital requirements and treat clients fairly.

International Differences: Regulations vary in other countries, so always check the governing body in your jurisdiction to confirm your broker’s legitimacy.

How to Improve Your Forex Trading Skills

Continuous learning is key to long-term success in Forex trading. Here’s how beginners can stay ahead:

Take Courses: Online platforms like TradingView and MetaTrader 5 offer tutorials to improve trading strategies.

Practice with Demo Accounts: Before risking real money, practice your skills using demo accounts available on most trading platforms.

Join Trading Communities: Engage with other traders through forums and social media groups. Sharing experiences helps avoid common mistakes and accelerates learning.

Follow Market News: Stay updated on global events that may impact currency pairs like USDJPY or EURGBP, using platforms like News Feed on cTrader or MetaTrader 4.

In summary, understanding the risks and challenges of Forex trading, such as market volatility, emotional control, scams, and regulations, will help traders minimize losses and improve their skills for future success.

The Future of Forex Trading for Beginners

The Forex market is rapidly evolving, shaped by emerging technologies, changing global dynamics, and new trading platforms. For beginners, understanding these shifts is key to adapting and thriving in the future of Forex trading.

Emerging Trends in Forex Trading

In the coming years, several trends are set to reshape the Forex market:

Algorithmic Trading: Automated trading systems will become more prevalent, using MACD and RSI indicators to make high-speed trades based on market data.

Artificial Intelligence (AI): AI-powered tools will analyze vast amounts of market data, identifying patterns and making more accurate predictions in real time.

Blockchain Technology: Blockchain could revolutionize Forex transactions by providing faster, more secure cross-border payments, reducing reliance on traditional banking systems.

Low-Cost Brokerage Models: With technology cutting down costs, MetaTrader 5 brokers may offer even lower spreads, encouraging more beginners to trade.

The Role of Cryptocurrencies in Forex

Cryptocurrencies like Bitcoin and Ethereum are increasingly influencing the traditional Forex market:

Volatility: Cryptos bring a new layer of volatility that traders can exploit. For instance, BTC/USD shows unpredictable price movements, often leading to increased trading opportunities.

Diversification: Many Forex traders are adding crypto assets to their portfolios, expanding beyond traditional currency pairs like EURUSD to trade digital currencies.

Integration with Forex: Platforms like cTrader and MetaTrader 4 are already allowing traders to access both traditional and crypto markets, simplifying trading strategies.

Can Forex Trading Be Done on Mobile Devices?

Forex trading is now more accessible than ever thanks to mobile apps:

MetaTrader 4 & 5 Mobile Apps: These apps offer the same functionality as their desktop versions, enabling traders to place Market Orders, adjust Stop Loss levels, and monitor positions from anywhere.

Convenience: With mobile trading apps, traders can access real-time market data, execute trades on AUDUSD, and even use Fibonacci Retracement for technical analysis.

Risk Management on the Go: Traders can set up Take Profit and Stop Loss orders from their mobile devices, ensuring they manage risk while on the move.

| Mobile Trading Platforms | Key Features | Pros | Cons |

|---|---|---|---|

| MetaTrader 4 | Real-time market analysis, automated trading | Wide use, advanced charting tools | Can be overwhelming for beginners |

| MetaTrader 5 | Multi-asset trading, more timeframes | Fast execution, powerful tools | Some features require learning curve |

| cTrader | Speed, ease of use, detailed order management | Great for scalping, user-friendly | Limited educational resources |

How Global Events Affect Forex Markets

Global events have a powerful impact on Forex markets, especially for currency pairs like GBPJPY and USDCHF:

Political Events: Elections, policy changes, and government instability can drastically influence currency prices. For example, Brexit caused significant volatility in GBPUSD.

Economic Reports: Economic indicators such as GDP, inflation, and unemployment rates affect the strength of a currency. Strong U.S. economic data often strengthens the USD, while weaker data can cause the dollar to drop.

Natural Disasters: Events like hurricanes or earthquakes can disrupt economies, leading to shifts in currency values, especially for countries heavily reliant on natural resources.

In summary, the future of Forex trading will be shaped by technology and global events. As AI, cryptocurrency integration, and mobile platforms rise, beginners will need to adapt their strategies to stay competitive. Understanding these trends will help traders navigate the market's ever-changing landscape.

Conclusion

Ultimately, while Forex trading offers great potential, it’s not a guaranteed path to profit, especially for beginners. Success in the Forex market hinges on a clear understanding of essential tools, strategies, and risk management. Currency pairs, trading platforms, and understanding key concepts like market orders and timeframes are crucial for making informed decisions. Beginners should start with practice accounts and gradually develop a solid trading strategy to navigate the complexities of the market. With the right mindset, education, and risk management, it is possible to profit in Forex trading—but it's essential to stay realistic and patient.