Introduction

Forex trading, one of the largest financial markets globally, involves the exchange of currencies between traders. A popular way to trade forex is through Contracts for Difference (CFDs), which allow traders to speculate on price movements without owning the underlying asset. Forex CFDs have become widely used due to their flexibility, low entry barriers, and potential for high leverage. In this article, we’ll explore the concept of Forex CFDs in depth, examining how they work, their advantages, and the risks associated with them. We will also discuss industry trends and how Forex CFDs are being utilized by traders across the globe.

What Are Forex CFDs?

Forex CFDs are financial derivatives that allow traders to speculate on the price movements of currency pairs without actually buying or selling the underlying currencies. Instead, a CFD is a contract between a trader and a broker that pays the difference between the opening and closing prices of the trade. This enables traders to profit from both rising (going long) and falling (going short) markets.

Key features of Forex CFDs include:

Leverage: Forex CFDs often offer leverage, meaning traders can control a large position with a relatively small amount of capital. For example, with a 1:100 leverage ratio, a trader can control $100,000 worth of currency with just $1,000.

Bid-Ask Spread: Traders buy at the ask price and sell at the bid price. The difference between the two is the broker's profit margin.

No Ownership of Underlying Asset: Since CFDs are derivative products, traders do not own the actual currency but are speculating on its price changes.

CFD trading platforms such as MetaTrader 4 and MetaTrader 5 are widely used by traders for executing these types of contracts.

How Forex CFDs Work

Forex CFDs allow traders to gain exposure to currency price movements by opening positions that represent a certain number of contracts. If the price of the currency pair moves in the trader’s favor, the trader can close the position and earn a profit. Conversely, if the price moves against the trader, a loss is incurred.

For instance, a trader who believes that the EUR/USD pair will rise may open a long position by buying CFDs. If the EUR/USD price increases, the trader can close the contract at a profit. If the price declines, the trader incurs a loss. Similarly, if the trader expects the currency pair to decline, they can open a short position.

Advantages of Forex CFDs

Forex CFDs offer several advantages that make them appealing to both new and experienced traders.

1. Access to Leverage

One of the primary benefits of trading Forex CFDs is the ability to use leverage. This allows traders to amplify their market exposure and potential profits. However, leverage can also magnify losses, making risk management essential.

2. Flexibility in Market Direction

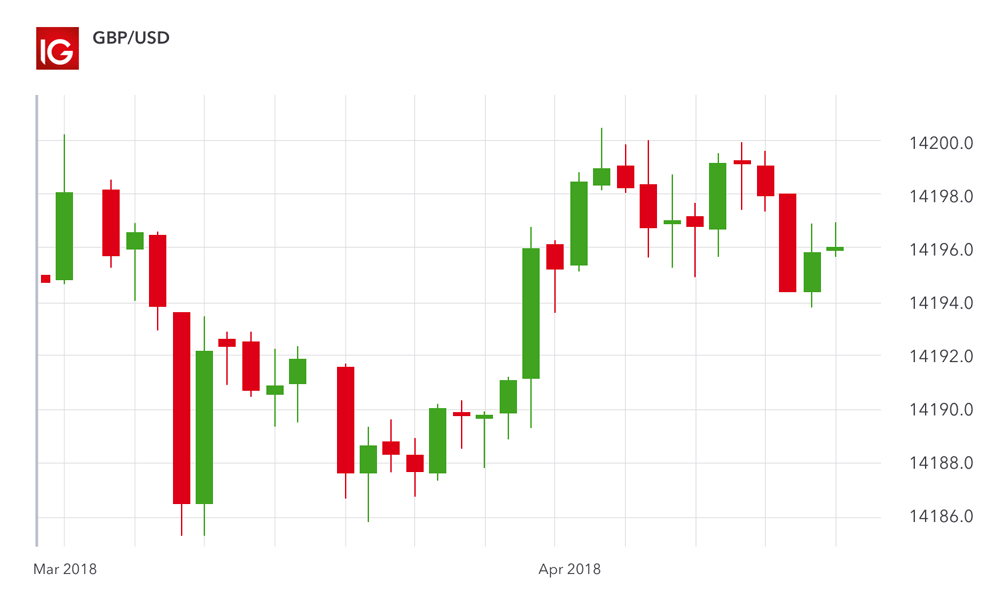

Forex CFDs allow traders to profit from both rising and falling markets by going long or short. In a highly liquid market like forex, this flexibility offers traders more opportunities to capitalize on market movements. For example, during the Brexit referendum in 2016, many traders used CFDs to profit from the volatility in the GBP/USD currency pair, regardless of the direction of price movement.

3. No Ownership of Underlying Assets

Since Forex CFDs are purely speculative instruments, traders do not have to deal with the complexities of owning the actual currencies. This simplifies the process, as there are no concerns about storage, exchange rates, or transfer fees.

4. Wide Range of Currency Pairs

Forex CFDs offer access to a broad range of currency pairs, including major, minor, and exotic pairs. This enables traders to diversify their portfolios and explore markets beyond just the commonly traded currencies.

Risks of Forex CFDs

While Forex CFDs provide numerous advantages, they are not without risks. It is important for traders to understand these risks to make informed decisions.

1. Leverage Risk

Leverage can work both ways: while it amplifies profits, it also magnifies losses. A small unfavorable market movement can quickly deplete a trader’s account. For instance, a 1% adverse price movement in a highly leveraged position could result in a 100% loss of the trader’s capital. Proper risk management, including the use of stop-loss orders and position sizing, is critical in leveraged trading.

2. Market Volatility

Forex markets can be highly volatile, especially during significant geopolitical events or economic data releases. In such periods, price gaps may occur, leading to significant losses if a trader is unprepared. According to a 2022 report by the Bank for International Settlements (BIS), the foreign exchange market saw increased volatility during key events like the Russian invasion of Ukraine and the tightening of U.S. monetary policy.

3. Counterparty Risk

Forex CFDs are traded over-the-counter (OTC), meaning trades are made directly with a broker rather than on a centralized exchange. This exposes traders to counterparty risk – the risk that the broker may default on their contractual obligations. It’s essential to trade with reputable and regulated brokers to mitigate this risk.

4. Spread and Fee Costs

Though brokers typically advertise tight spreads, these can widen during periods of high market volatility, increasing trading costs. Additionally, some brokers charge overnight fees for holding CFD positions, which can add up over time if trades are held for extended periods.

Industry Trends in Forex CFDs

The use of Forex CFDs has grown substantially over the past decade, driven by advancements in technology and increased accessibility to online trading platforms. According to data from the Financial Conduct Authority (FCA), retail traders account for a significant portion of Forex CFD trading volume, with more traders leveraging sophisticated trading tools and automation technologies.

Furthermore, brokers have been offering increasingly competitive trading conditions, including lower spreads and more educational resources to attract a broader client base. However, as retail participation increases, so does the need for regulatory oversight. European regulators, such as the European Securities and Markets Authority (ESMA), have introduced leverage caps and margin requirements to protect retail traders from excessive losses.

Conclusion

Forex CFDs have become an integral part of the forex trading landscape, offering traders the opportunity to profit from currency fluctuations without the complexities of owning the underlying asset. While CFDs provide access to leverage, flexibility in market direction, and a wide range of currency pairs, they also come with inherent risks such as market volatility and counterparty exposure. Both new and experienced traders can benefit from understanding how Forex CFDs work and employing sound risk management practices to navigate this dynamic market.

In the ever-evolving world of forex trading, Forex CFDs remain a versatile and powerful tool for traders looking to capitalize on global currency movements. By staying informed about industry trends, market conditions, and risk factors, traders can make better decisions and increase their chances of success in this fast-paced market.

Take your earnings further with the best forex rebates available!