Introduction

Intraday Forex trading, or day trading, involves buying and selling currency pairs within a single trading day. Success in intraday trading requires fast, data-informed decisions based on real-time market conditions. With the right strategies, traders can capitalize on short-term price fluctuations to generate steady gains. This article outlines the best Forex intraday strategies, focusing on trend analysis, indicator-based approaches, and practical application to help both novice and experienced traders.

1. Trend-Following Strategy

Trend-following is one of the most reliable approaches in Forex intraday trading. This strategy involves identifying and trading in the direction of the prevailing market trend, leveraging momentum for profitable trades. Trend-following strategies are often based on price action and technical indicators that reveal directional movement.

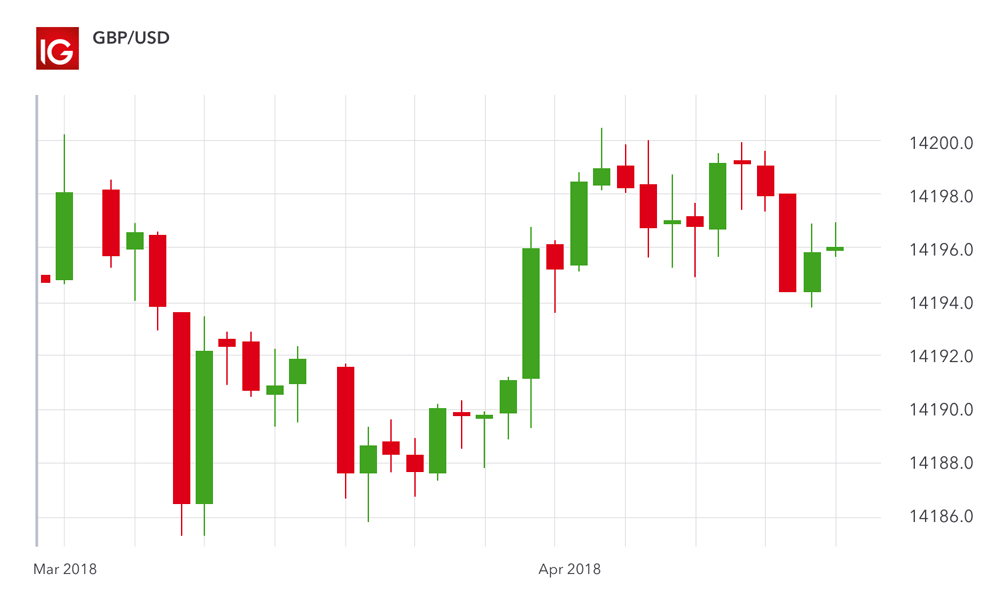

Identifying Trends with Moving Averages: Moving averages, such as the 50-period or 200-period MA, are commonly used to identify trends in intraday trading. When the price stays above the moving average line, it signals an upward trend, while a price below indicates a downward trend. The moving average crossover, where short-term MAs cross long-term MAs, serves as a reliable entry signal. Traders often use this method on popular pairs like EUR/USD and GBP/USD for clear trend analysis.

Trend Confirmation with the MACD Indicator: The Moving Average Convergence Divergence (MACD) is widely applied for trend confirmation. Positive or negative histogram bars on the MACD chart indicate the trend's strength, helping traders determine potential entry and exit points. Research shows that MACD works effectively with currency pairs exhibiting strong trends, such as USD/JPY and AUD/USD.

User Feedback: Many traders on platforms like Forex Factory report success with trend-following, particularly when using simple MA and MACD combinations for clear signals. These tools allow traders to make decisive moves in trending markets, reducing the likelihood of false signals in volatile conditions.

2. Breakout Strategy

Breakout trading is based on identifying levels of support and resistance and entering trades when price breaks through these levels. Since breakouts often precede significant price moves, this strategy allows traders to capture intraday volatility effectively.

Using Support and Resistance Zones: Breakouts occur when the price breaches a critical support or resistance level. For instance, if EUR/USD breaks above a strong resistance level during the European session, it can signal a continued upward move. Traders use the Average True Range (ATR) indicator to gauge potential breakout volatility, setting stop-loss and take-profit levels based on the range.

Time Frames for Breakouts: Intraday traders often focus on shorter time frames, such as the 15-minute or 30-minute charts, to detect breakouts early in the trading day. By monitoring price action near these levels, traders increase their chances of catching breakout moves.

Positive Trader Experiences: Many traders find breakout strategies effective during high-volume trading hours, such as the overlap between the London and New York sessions. Breakouts tend to be more reliable during these periods due to increased liquidity and volatility, which supports stronger price movements.

3. Scalping Strategy

Scalping is an intraday technique focused on making small profits from minor price movements. Scalpers execute multiple trades within short timeframes, holding positions for a few seconds or minutes, aiming for incremental gains that accumulate over time.

Applying the Stochastic Oscillator for Entry Points: The Stochastic Oscillator helps scalpers identify overbought and oversold levels, crucial for pinpointing quick entry and exit points. For instance, when the oscillator indicates an oversold level, scalpers may enter a short-term buy position on a pair like USD/CHF.

High-Frequency Execution on Low Spreads: Since scalping involves frequent trades, low spreads are essential to minimize costs. Brokers like IC Markets and Pepperstone offer low spreads, enabling scalpers to profit from small moves without significant transaction costs.

User Feedback and Platform Choices: Scalping is widely regarded as a challenging yet profitable method when practiced on fast, responsive platforms like MetaTrader 4. Many traders report that scalping on major pairs like EUR/USD and USD/JPY, which have tight spreads, helps achieve consistent gains with minimal execution delays.

4. News Trading Strategy

News trading takes advantage of market volatility triggered by economic announcements, such as interest rate decisions or employment reports. This strategy requires a solid understanding of economic indicators and the ability to make quick decisions during high-impact events.

Economic Calendar for Tracking Events: Intraday traders follow an economic calendar to anticipate events that could move the market. For example, non-farm payroll (NFP) data in the U.S. is known to cause significant fluctuations in the USD. Traders use platforms like TradingView or Investing.com to stay informed on upcoming news events, setting trade alerts for timely action.

Volatility Indicators for Market Reaction: The ATR and Bollinger Bands indicators are effective tools for gauging market volatility before and after news releases. High ATR values indicate increased volatility, while Bollinger Bands help traders spot price breakouts during events.

Trader Feedback and Strategies: News trading can be challenging due to sudden price spikes, but experienced traders on Myfxbook report that it can yield substantial gains. They emphasize practicing with a demo account and understanding market sentiment to anticipate price direction before committing to live trades.

5. Range Trading Strategy

Range trading is a strategy based on the idea that currency prices often move within a defined range, bouncing between support and resistance levels. This strategy works well in stable market conditions, where price moves are less directional.

Support and Resistance Indicators: Range traders identify strong support and resistance levels on the 1-hour or 4-hour chart, entering buy positions near support and sell positions near resistance. By applying indicators like RSI, traders confirm overbought or oversold levels that align with range boundaries.

Applying Stop-Losses and Take-Profits: In range trading, defining stop-loss and take-profit levels within the range prevents losses from unexpected breakouts. Traders set stop-losses just outside support or resistance to limit risk.

Positive Experiences from Range Trading: Many traders on Forex Factory mention that range trading is effective during low-volatility sessions, such as the Asian trading hours. The strategy is preferred for pairs like EUR/CHF and AUD/NZD, which often exhibit stable ranges.

Conclusion

Forex intraday trading can be approached through various strategies, each catering to different market conditions and trading styles. Trend-following strategies work well for capturing directional movement, while breakout trading leverages support and resistance levels for volatile market entries. Scalping provides high-frequency trades in tight spreads, while news trading focuses on market reaction to economic events. Lastly, range trading offers a method to profit in stable markets. By applying these strategies with discipline, Forex traders can navigate intraday opportunities and enhance their success in the fast-paced Forex market.

Get paid for your trades with premium forex rebates!